Running a business or Small Businesses can feel like a Herculean task at times, and even before considering the various objectives we are trying to achieve. As we are working long days and through weekends to build a brand and find the growth we are aiming for, we can streamline processes by making use of some handy mobile finance apps.

These can be a great help in organizing your finances and letting you focus on the part that is the most important to you.

Tech-related issues can often become an overwhelming encumbrance. UK-based businesses may choose to find an IT support company based in London that is experienced and reliable.

1. Square

Square is a useful mobile app that enables card transactions on the go. This is possible with the use of a POS credit card reader that can easily be fitted on a mobile device so that payments can be made.

There is a 2.75 percent fee for each transaction, and accounts are credited within one or two days. No merchant account is needed, so this is cheaper than traditional methods.

Sales data and analytics are also given, and online invoices and marketing invoices can be sent to customers. The application is free, but there is a $25 charge for the card reader.

2. Quickbooks Mobile

This mobile app integrates with Quickbooks Online, so accounting needs can be accessed and managed wherever you may be. The app can be used to edit and create customers, invoices, estimates, and sales receipts.

It can also be used to view financial statements, track expenses and sales, review unpaid invoices, and pay employees and vendors, among other essential accounting needs.

It can connect and upload to different accounts, including business accounts, PayPal, credit cards, or Square. It can also work on business taxes and maximize tax deduction. Quickbooks has a 30-day free trial, and then plans start from $7.50 per month.

3. Xero

Xero is a New Zealand-based company with more than 1.5 million users throughout the world. It is a business accounting app that is aimed at small businesses. Users of the app can send invoices, create expense claims, and import and categorize all bank transactions.

All information can be saved to the cloud and accessed across all mobile devices. Xero has more than 700 integrations, from Asana to WooCommerce. The app offers a 30-day free trial, after which plans start from $7.50 per month.

4. inDinero

An accounting and taxation app for SMEs, inDinero, is scalable and easy to use. The app enables users to access and review their finances, generate reports, and categorize transactions. The app can also take on inventory management, invoicing, and credit card processing.

Users can work with a team of financial advisors through the interface, and custom charts, financial statements, and a receipt matching service are also available.

A wide range of additional services is provided, including advice from business tax experts and CPAs. The basic plans are priced at $300 per month, while custom packages vary in price.

5. Mint

A big name in budgeting apps, Mint is a respected brand in tracking budgets and bills. Mint accounts can be connected to banks, credit cards, and loan accounts, and then the app gathers data to make suggestions.

‘MindSights’ is a project that it uses for making personal recommendations, such as how to invest wisely. Mint also provides a wide range of features for managing finances, and invoices can also be added and tracked. The app is free, although it does earn money by including offers in its suggestions.

6. FreshBooks

FreshBooks is an accounting app aimed at freelancers and startups, that is user friendly and easy to learn. It also comes with an excellent level of customer service. It can be used for creating invoices, receiving payments, or tracking time and expenses.

In the new version of FreshBooks, there is a General Ledger and Chart of Accounts, Other Income, bank reconciliation, Cost of Goods Sold (COGS), and additional financial reports.

FreshBooks is professional, personalized, and is known for the way it can streamline the invoicing process. The app offers a free trial, after which plans start from $7.50 per month.

7. Wave

Another mobile app that is aimed at small businesses, contractors, and sole proprietors, Wave, has more than four million users in 200 countries.

It can be used by up to nine employees in a business. Wave offers a wide range of accounting features that include billing and invoicing, tax management, expense tracking, payroll management, and fixed asset management. Stream provides freelancers and small businesses some room for growth, though this is limited.

It doesn’t include time tracking, but it otherwise provides all the necessary tools for accounting. The Wave app is free, with two payroll options that come at an extra price.

Once the most suitable finance app has been chosen for your business, users are most likely to reap the benefits and watch their operations become more streamlined. The best apps are an incredible advantage to us all, so time should be spent reviewing and deciding on the best possible fit.

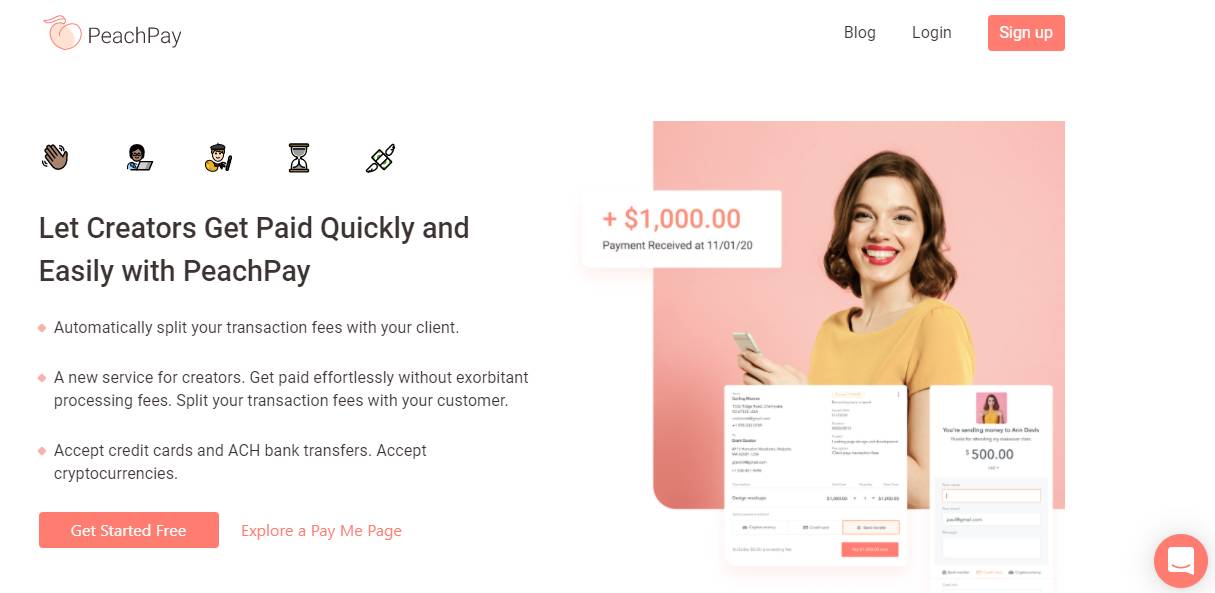

8. PeachPay

PeachPay is a useful invoicing software for freelancers and small businesses. It provides users to split their transaction fees into three modes like to half of the transaction fee or payer can pay or receiver can pay.

PeachPay offers you to send invoices to more than 100 different currencies as well as a huge range of cryptocurrencies.

Tech Trends

Related posts

Leave a Reply Cancel reply

Hot Topics

Categories

- Ads (5)

- Animes (25)

- Artificial Intelligence (AI) (35)

- Augmented Reality (AR) (10)

- Automotive (9)

- Bitcoin (16)

- Blockchain (24)

- Business (244)

- Business Intelligence (3)

- Cloud Computing (23)

- Computer (128)

- Concrete Technology (1)

- Cryptocurrency (10)

- Cybersecurity (42)

- Data Science (9)

- Database (4)

- DevOps (6)

- Digital Marketing (76)

- Digital Workplace (14)

- Ecommerce (1)

- Education (28)

- Electric Vehicle (EV) (1)

- Electronics & Hardware (17)

- Entertainment (42)

- Fabrication (3)

- FAQ's (1)

- Finance & Marketing (47)

- Gadgets (35)

- Games (8)

- Gear (29)

- HTTPS (1)

- Industry (46)

- Information Technology (90)

- Internet (413)

- Internet of Things (IoT) (41)

- Job (25)

- Machine Learning (6)

- Marketing (92)

- Mobile Apps (21)

- Movies (11)

- Natural Language Processing (6)

- News & Trends (109)

- Programming (4)

- Science & Technology (235)

- Security (81)

- SEO (56)

- Services (36)

- Social Media (73)

- Software (99)

- Sports (1)

- Technology (306)

- Telecom (6)

- TikTok (5)

- Tours & Travels (9)

- Uncategorized (11)

- Virtual Reality (VR) (7)

- VoIP (4)

- Web Technology (42)

- Workforce (17)

- Workspace (6)

Stay connected